By Marcus Kiel | June 22, 2020

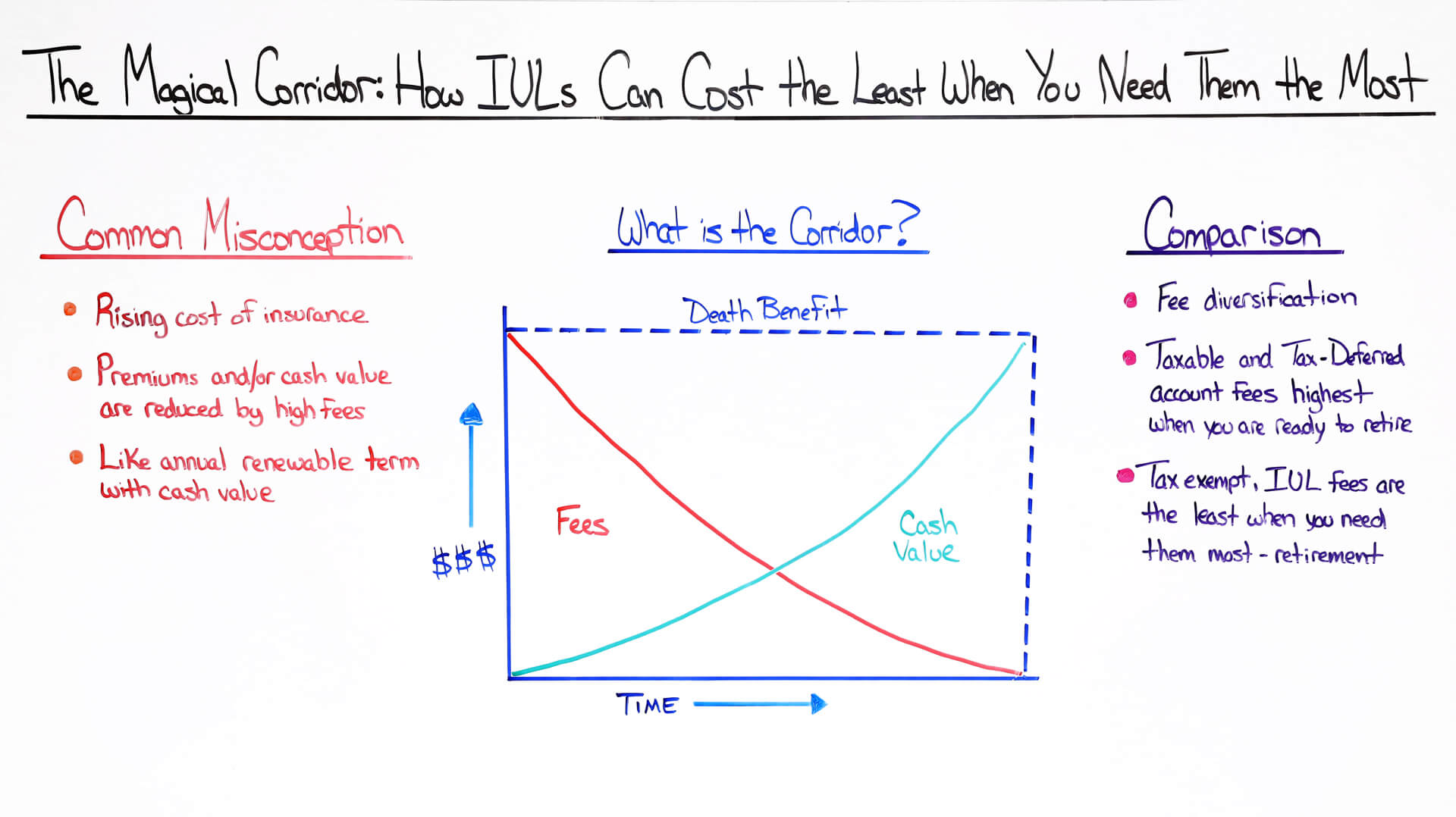

An Indexed Universal Life policy allows the cash value to grow when certain stock market indexes are doing well, while protecting you from losses. But like any financial vehicle, there are criticisms that keep people from moving forward with purchasing a policy.

In this episode of Money Script Monday, Marcus dispels a common misconception about high Indexed Universal Life policy fees as you approach retirement.

Click on the whiteboard image above to open a high-resolution version of it!

Video transcription

Hello, my name is Marcus Kiel. Thank you for watching another episode of Money Script Monday.

Today, we’ll be talking about the magical corridor, how IULs can cost the least when you need them the most.

We’re going to talk about common misconceptions about IULs. We’re going to debunk those myths with the corridor and what the corridor is.

And then lastly, we’re going to talk about the comparison of other financial vehicles. So, let’s get started.

Common Misconceptions

Common misconceptions that you’ve heard about IUL or you may hear is that there’s a rising cost of insurance.

As you get older, a lot of those fees reduce the cash value because of the rising cost of insurance.

And then lastly, IUL is nothing more than annual renewable term with cash value, meaning the longer you live, the higher the cost of insurance.

That’s the “why” behind what the corridor is and why it’s important. And by understanding that, you can debunk those.

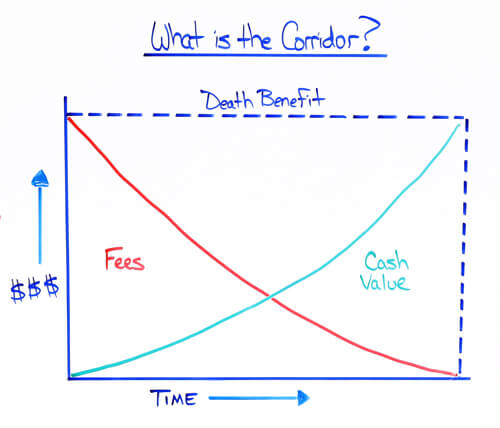

So now, let’s talk about the “what.” What is the corridor? So as you can see here, I have a nice graph here.

We have on our y-axis, these are dollars, money, ascending. On our x-axis, we have time. And then we have our redline fees, cash value, and then this blue line is death benefit.

What is the Corridor?

To answer the question “What is the corridor,” the corridor is the difference between the death benefit or face amount and the cash value in green.

Green’s good. Green’s money. So that difference from the green line to the blue line is your corridor or net amount of risk.

Why is that important?

When you first take out your policy, your death benefit is the highest as far as the difference between your cash value and death benefits.

This big difference here is why our fees are so high early on.

As time progresses, the fees start to come down and our cash value starts to come up, and so, that difference starts to shrink until you get ready to retire when you need the funds the most.

That net amount of risk, that corridor is the smallest. So, when you’re ready to retire, look at where our fees are.

They have plummeted down, and our cash value has increased.

When someone talks about how you always have a rising cost of insurance and that the premiums and cash value are reduced by the high fees, you will know that that’s not the case because we’re paying premiums on this corridor difference and not on the entire death benefit like we were in the beginning.

As far as the annual renewable term, yes, as you get older, the cost of insurance does go up. But once again, you’re paying on this difference here and not the whole amount.

And that’s the magic. You’re paying on the net amount of risk and not the entire risk.

So that’s the “what.” That’s what is the corridor, the difference of the death benefit and the cash value.

And over time, when you need it the most and you’re ready to retire, the fees are the least.

Comparison

Now, let’s compare. We believe in having a fee diversification, having three buckets of money: your taxable, tax-deferred, and tax-free.

With your taxable and tax-deferred account, those fees are the highest when you’re ready to retire.

Remember, you’re paying on the entire harvest, not the seed and so, that 1%, 1.5%, 2%, when you’re ready to retire, it’s on that large amount.

Compare that to now, if you will, which is tax-exempt, when you’re ready to retire, that’s when the fees are the lowest.

When you’re ready to distribute income, when you’re ready to retire, that’s when you’re paying the least amount in fees. And so that’s the magic and that can be proved by the corridor.

In summary, there’s a lot of misconceptions about IULs, rising cost of insurance, high fees, premiums being eaten up by those fees.

Those can be debunked by talking about the corridor, once again, the net amount of risk, the difference between the death benefit and the cash value, fees high early on when you take out the policy.

However, over time, when you’re ready to retire, you’re paying on the difference here, and that’s the corridor.

When you compare that to other vehicles, you’re actually paying the least when you’re ready to retire, unlike your tax-deferred and taxable accounts.

Once again, my name is Marcus Kiel. Thank you for watching. Please consult your local financial professional. Thank you.

About Marcus Kiel

Marcus Kiel is a Field Support Representative at LifePro. He coaches hundreds of financial professionals on how to build effective financial strategies that achieve their clients’ long term goals and helps them stay educated on the latest industry trends.