By Adam Reyna | August 10, 2020

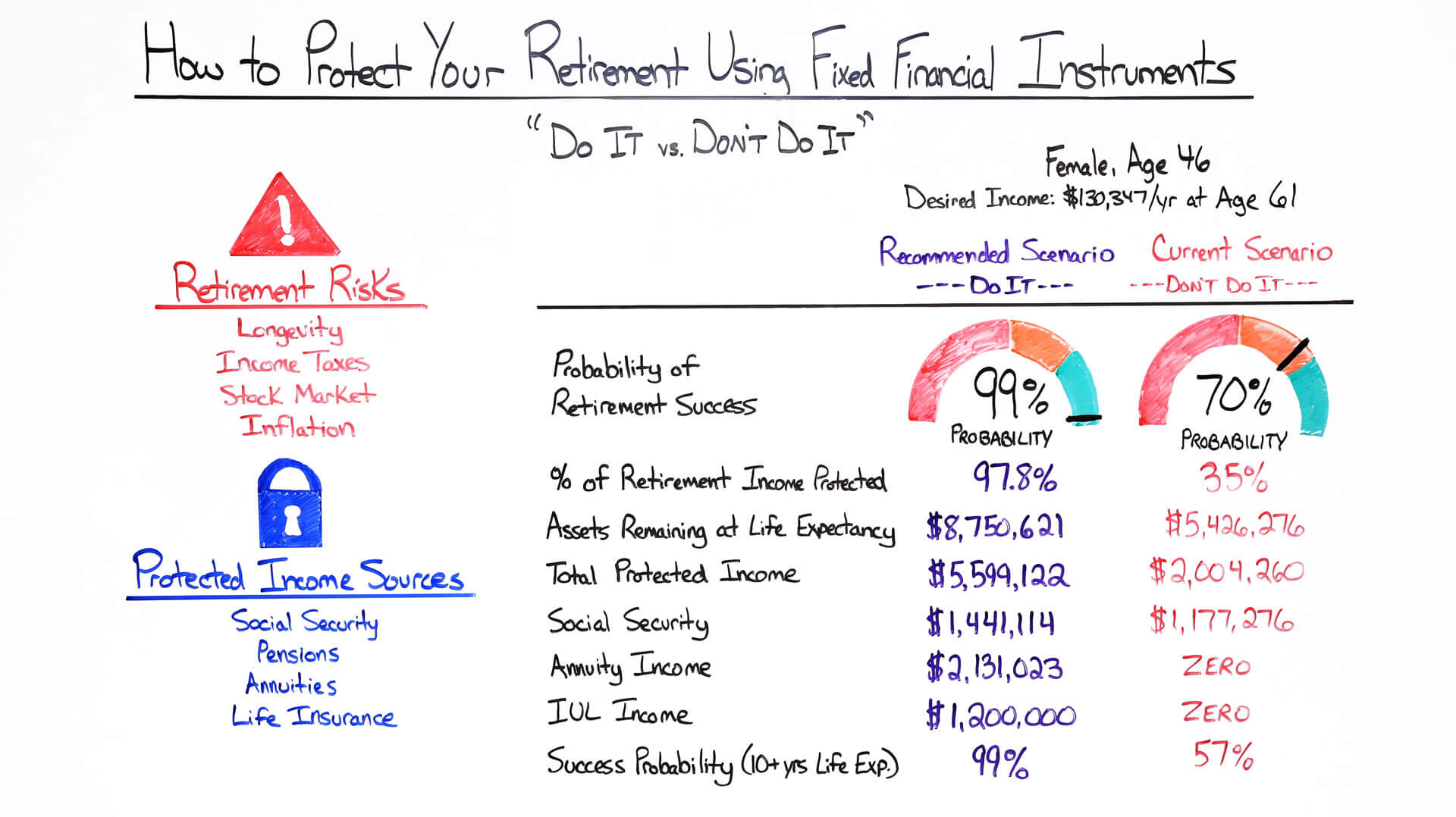

Studies have shown that retirees who secure a base level of guaranteed lifetime income live happier lives. In this episode of Money Script Monday, Adam explains how to live comfortably in retirement by adding sources of protected income to your financial planning strategy.

Click on the whiteboard image above to open a high-resolution version of it!

Video transcription

Hello, everybody, and welcome to today’s video. I want to thank you for attending.

Today, we’re going to talk about retirement. And the way we’ll talk about retirement is in a few different ways. First off, our title of today’s presentation is “How to Protect Your Retirement Using Fixed Financial Instruments.”

What we’ll do is we’ll talk about some of the risks in retirement, we’ll talk about some protected income sources, and then we’re going to look at a do it vs. don’t do it actual real-life case scenario.

Before I get started I want to talk about a relationship with your financial adviser. If you were to walk into his or her office and say, “Mr. or Ms. Financial Adviser, I want to retire.”

What is the first thing they have to ask you? “Okay, well, where are you today?” We want to look at retirement as a bit of a journey.

If you’re asking for directions, and you told me, “Adam, I wanted to come to San Diego,” the first thing I have to ask you is, “Well, where are you?”

In order for me to give you directions of getting to San Diego, you have to tell me where you are, you have to tell me how long you have to get here, how many stops you want to make along the way, who’s coming with you, what kind of transportation you have.

At that point, when we’re relating that to relationship with the financial adviser, what we’re looking at is some fact-finding, some data gathering so we understand your current situation.

Because in order to make any sort of recommendations for a successful retirement, we do need to, again, know the status quo of where you are today.

Retirement Risks

With that said, we’ll talk about some of the different way to relay that information to your financial adviser, but before we do that, let’s talk about some of the risks in retirement.

That journey we talked about, these are some things that can throw that journey off path.

One of the first ones I want to talk about is longevity. And essentially, that means people are living longer and longer these days.

We literally have to plan for maybe 30, 40 years in retirement, depending how soon you want to retire and how long you may live.

Healthier lifestyles, better healthcare, again, people are living longer and longer, so we have to plan for different types of income that you will hopefully never outlive.

Second risk we want to talk about are taxes. We really have no way of knowing what taxes are going to do in the future, but I think a lot of people would agree that taxes are going to go up, with the amount of spending our country has been doing, the amount of debt.

We really have a pretty low-income tax environment right now, so we would assume that they are going to go up.

What we’ll talk about down in the protected income sources is some ways to mitigate those taxes.

Third one we’re going to talk about is stock market risk. I think everybody knows the stock market can go up but it can also go down.

What we’ll look at is ways to protect that income, and when we look at the case scenario, your probability of retirement success really is affected a lot by not only the stock market volatility, but some of the other risks that we’ll talk about there as well.

And finally, we have inflation. Inflation is about an average of 3% every single year, so what we want to do with our sources of retirement income is hopefully have those increase to account for inflation and protect the purchasing power of your dollar.

Any questions on those, you can talk a lot further with your financial adviser, just meant to be a quick overview.

Protected Income Sources

We talked about the risk, let’s talk about the protected income sources. We have four listed there.

The first we’ll talk about is Social Security. I think everybody knows what Social Security is.

Essentially, you work for X amount of years, you pay into Social Security, and then when you do get to a specific age, the government will give you that money back.

During our do it vs. don’t do it strategy, one thing that we offer is showing you how to increase your Social Security benefit.

Really, how to maximize that and get the most out of Social Security as possible, and there’s a lot of different ways to do that, so again, we rely on the financial adviser to show us how to maximize Social Security.

Number two, we have pensions. Again, a lot of people worked for 30, 40 years with the same company, they’ve paid into a pension, and that company, of course, agrees to give you a stream of income for you and potentially your spouse through retirement, through life expectancy.

But I’ll tell you, pensions are very rare these days, so a lot of that savings, if you are still in your working years, and you maybe don’t work for a government agency, that savings responsibility is going to be on us to make sure we plan for retirement.

Okay, then we have annuities and life insurance.

A lot of people, they hear the word annuity, and they may have a bad taste in their mouth or may not know too much about them, so really, we encourage you to learn about annuities, because annuities, believe it or not, are just like Social Security.

Essentially, what you would do is take a portion of your assets, whether in the market or sitting in an idle account, like a checking or a savings, you would give them to an insurance company, and that insurance company in turn is going to give you a stream of income for the rest of your life that you can’t outlive.

We’re taking away the stock market risk there, we’re accounting for longevity. Again, it’s a source of protected income, which means it’s not subject to stock market risk, and you cannot outlive that income.

Ask your financial adviser to go more in depth about an annuity.

Lastly, we’ll talk about life insurance. Believe it or not, life insurance, you can add premium to a life insurance policy, build up some cash value, and then eventually, when you get to retirement, there’s enough cash value in that policy to take a tax-free stream of income.

Again, we’re checking off some boxes there. We’re accounting for taxes, we’re accounting for stock market volatility, and then we can have those inflation adjusted as well, so we will make sure they increase to outpace inflation, and then of course, be there for the rest of your life.

Case Study

Again, just a brief overview there, but we covered the risks, we covered the protected income sources. Now, let’s look at a case study here. So I’ll step out of the way, and what we’re looking at is a do it vs. don’t do it strategy.

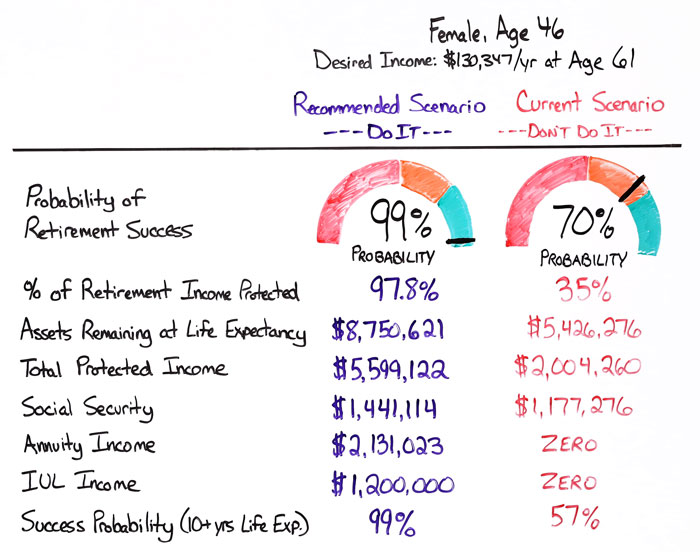

This woman that we are working with was 46 years old. She’d done a very good job saving, very well-diversified in a IRA, a Roth IRA.

She was purchasing her own company’s stock in the tune of about $20,000 per year. So she’d done a great job saving. And she’s hoping to retire at age 61.

What we did is we looked at her desired retirement income of $130,000 approximately per year for the rest of her life.

The financial adviser’s job here is to get her through that retirement journey with that $130,000 per year, again, for the rest of her life.

So if she stays in the market and stays in her IRA, her Roth and that company stock, she has a 70% probability of getting through retirement safely.

And we’ll we do is we’ll just kind of go down the line here and look at some of the different numbers.

Again, she had a 70% chance of getting through retirement safely. And why? Because she’s subject to some of those risks because she’s not using sources of protected income.

If you look at her percentage of income that is protected, it’s only 35%. So a healthy portion of that is still subject to the market.

If the market takes a big drop, she either has to live off less income, earn a better rate of return, save more somehow during retirement, so it’s going to throw that journey off path.

And her assets remaining at life expectancy are about a 5.4 million. She had a total protected income a little over 2 million.

And if you notice, she does not an annuity or life insurance involved in that plan, which, again, was a source of our protected income.

So, she took a couple recommendations here from the financial adviser she was working with, and what we did is moved a portion of IRA, which was in the market, into an indexed annuity, $200,000.

She had over $500,000 in there, so it was just a small portion that we moved over.

And then if you remember, I said she was contributing to a company stock portfolio of $20,000 per year where she had just under $200,000 in that account, so what we did is we redirected that $20,000 per year into a life insurance policy.

Again, an annuity and the life policy are sources of protected income that protect from those retirement risks that help us on our journey.

So, let’s look at the numbers here, now that she took a couple recommendations. The don’t do it was a 70% chance of getting through retirement with here a $130,000 o f income.

The do it strategy was, again, the recommendation of the annuity and the life insurance, and we got her up to 99%.

After a simulation here, we were able to show her a 99% success probability. And then if you look at her assets remaining at life expectancy because we took away that risk, it’s almost $3 million more at life expectancy.

Her protected income is way greater, so we have over $3 million more of protected income there, and these are the two important numbers here.

The Social Security, we maximized social security. And then of course, we added in the annuity and life insurance incomes.

So, those are 100% protected from the stock market, we’re accounting for inflation, and then the life insurance is also tax-free so we’re accounting for some good risk mitigation there as well.

Again, this is a little brief overview of a case scenario that we looked at, so please feel free to work with your financial adviser. Do some fact-finding, do some gathering if you’re near retirement or already in retirement.

They can still help you. And then of course, work with them to find out what your retirement success probability is and try and mitigate as many risks and use the sources of protected income as possible and that is it.

I appreciate your time. Again, my name is Adam Reyna.

About Adam Reyna

Adam Reyna is a Field Support Representative at LifePro. He coaches hundreds of financial professionals on how to build effective financial strategies that achieve their clients’ long term goals and helps them stay educated on the latest industry trends.